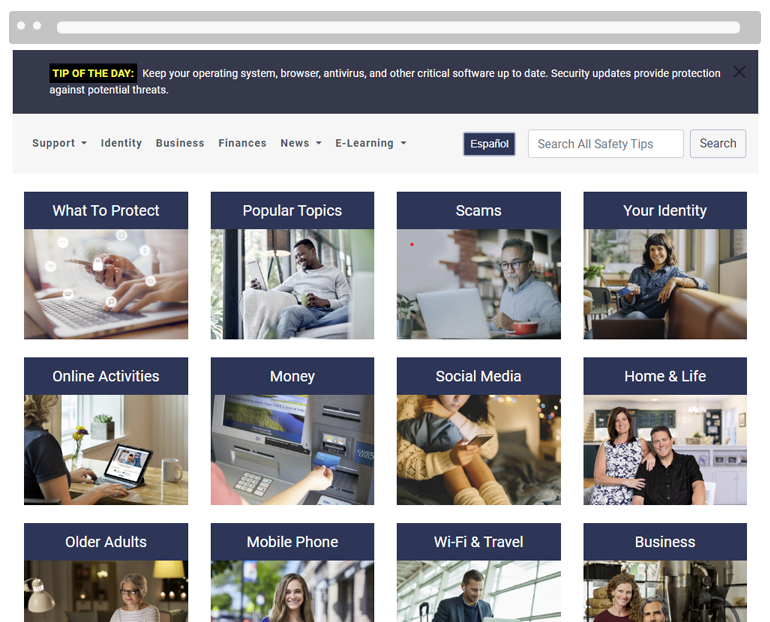

Website

Education and Awareness:Cape Cod 5 provides a comprehensive source of information on the various types of fraud, helping customers understand what to look out for and how to protect themselves.

Prevention Tools and Resources: Checklists, guides, and tips for customers to safeguard their financial information.

Latest Scam Alerts: Helping customers avoid falling victim to new tactics used by fraudsters.

24/7 Accessibility: As a part of the website, fraud awareness information is available any time the customer needs it.

Reporting Fraud: It provides clear instructions on how customers should report suspected fraud, speeding up the response time and minimizing potential damage.

Improved Engagement: Useful and practical tips are useful for engagement as members interact with, comment on, and share these posts, leading to greater visibility and reach on Facebook.

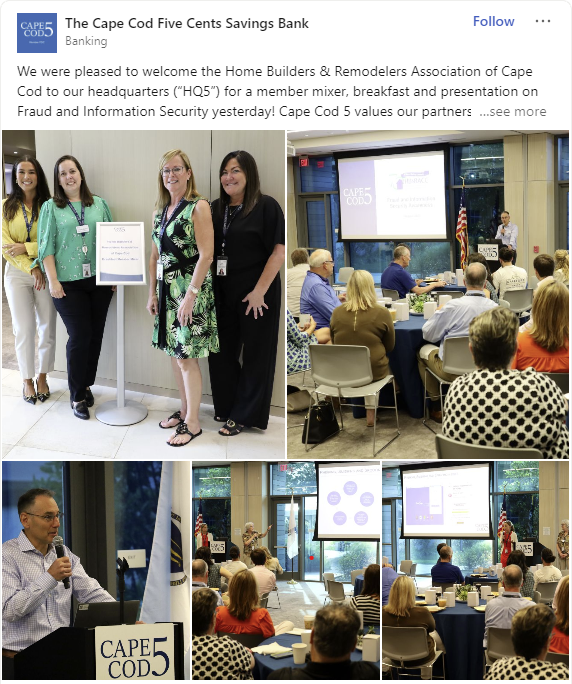

Presentations & Seminars

Enhanced Customer Trust: By showcasing eFraud Prevention measures and tools, the bank reinforces its commitment to safeguarding customer assets and personal information. This can enhance trust and loyalty among their clientele.

Proactive Risk Mitigation: In-person seminars that educate customers and businesses on eFraud Prevention techniques empower them to be proactive. This can help reduce the number of fraud incidents, as informed customers are less likely to fall victim to scams.

Promotion of Digital Banking Tools: Through these seminars, the bank can promote its own digital banking tools that come integrated with eFraud prevention features. This encourages customers to adopt secure banking practices, further reducing the potential for fraud.

Community Engagement: Hosting in-person seminars on fraud awareness showcases the bank's role as a community leader in financial education. It underlines their commitment not only to their customers but also to the larger community's well-being.

Reduction in Fraud-related Costs: Educating customers and businesses on how to prevent fraud can lead to a decrease in the number of fraud cases. This, in turn, can reduce the costs related to fraud investigation, reimbursements, and associated administrative tasks.