What is eFraud Prevention, and how does it work?

Established in 2004, eFraud Prevention™ is the nation’s most comprehensive fraud awareness education platform, helping banks and credit unions educate and protect account holders while supporting frontline teams with practical, real-world fraud resources. We are the education and engagement layer that makes a fraud prevention strategy actually work. In fact, several of our clients (BOKF, Bank United, First Financial Bank, Texas Capital Bank, Founders FCU, Keesler FCU, CommunityAmerica CU, Northwest FCU, Amerant Bank, Mechanics Bank, Stellar Bank, ORNL FCU, Fairwinds CU, Tower FCU, NASA FCU, Northwest Bank, Educators CU, First United Bank, Logix Banking, Fourleaf FCU, and Apple FCU) are listed in the top 100 largest banks and credit unions in the US.

Trusted by banks & credit unions nationwide

Simple, Ready-to-Use Fraud Awareness Solutions

eFraud Prevention is the “rocket fuel” for your fraud program—a FI-built platform that helps you deploy consistent, branded fraud education across every channel without adding workload.

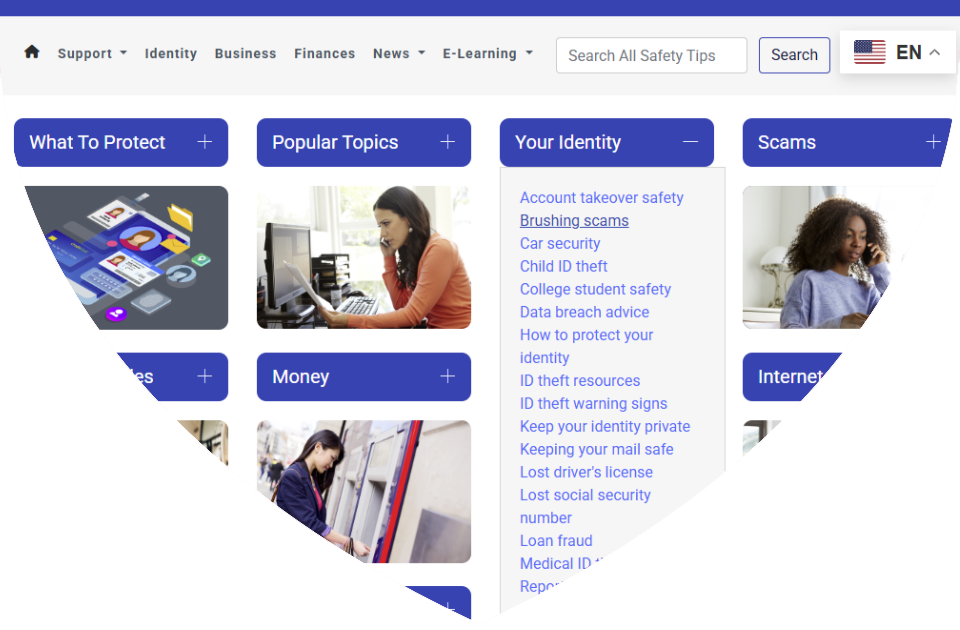

- Customer/Member education, ready to publish: articles, videos, courses, handouts, and social posts.

- Frontline enablement: red-flag checklists, conversation starters, and “what to do next” scripts.

- Campaigns & community engagement: branded toolkits, in-branch materials, and contests.

- Always current: fast updates for emerging scams and timely “breaking news” guidance.

Use it alongside anything you already have - ABA resources, in-house programs, fraud tools, core providers, or external partners. They do their job. eFraud Prevention helps you activate, communicate, and scale it to account holders and staff.

Whether you’re marketing, compliance, or fraud operations, eFraud Prevention gives you a single place to keep messaging current, support your teams, and build trust—through a proactive, branded experience your institution owns.

Going Beyond Education

eFraud Prevention doesn’t stop at providing fraud awareness. We partner with financial institutions to develop customized fraud strategies, ensuring they are prepared to address their specific vulnerabilities and challenges. Our services include:

- Fraud Prevention Strategies: Tailored recommendations to minimize risk and enhance security measures within organizations.

- Marketing Campaign Support: Assistance in creating and executing fraud awareness campaigns to engage account holders and educate the broader community.

- Employee Training: Resources and tools to improve fraud detection and prevention awareness among staff.

- Community Engagement: Programs and materials to foster trust and educate account holders on recognizing and avoiding scams.

By combining education with proactive strategies, marketing insights, and community-focused initiatives, eFraud Prevention helps financial institutions not only safeguard their customers but also build lasting trust and resilience in the face of emerging threats.

Celebrating 22 Years

We have proudly reached a 22-year milestone. eFraud Prevention offers 55 comprehensive applications tailored to modern banking, equipping financial institutions with tools to enhance fraud prevention and streamline operations.

Innovators In Fraud Awareness

eFraud Prevention™ was the first online service dedicated to offering consumer awareness for fraud prevention. We were an established online service before any private or government-funded consumer awareness initiatives existed.

Great Partnerships

eFraud Prevention is a strategic partner with the International Association of Financial Crimes Investigators (IAFCI). This 12-year collaboration has been pivotal in shaping fraud prevention outreach strategies, offering comprehensive education, and providing robust resources to IAFCI's vast network of over 8,000 professionals.