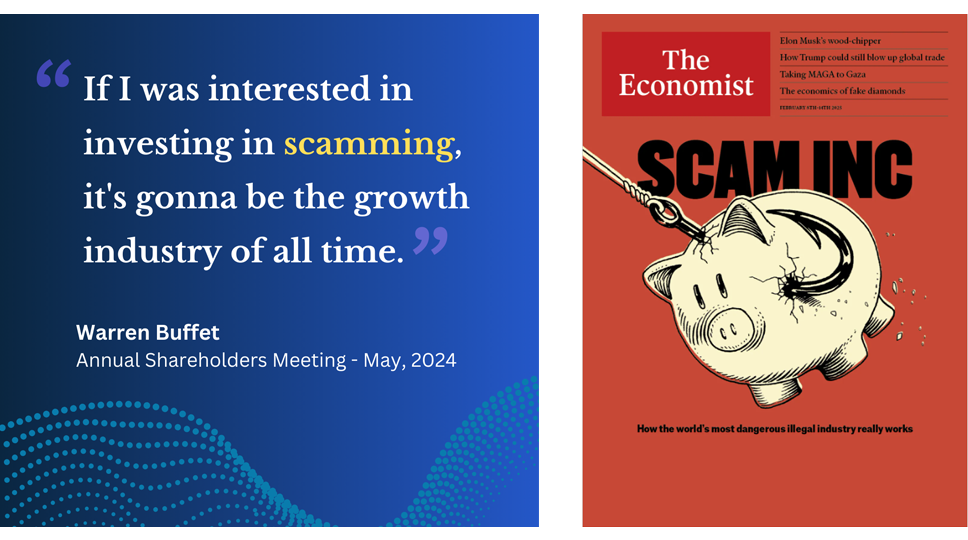

The Scam Age: Why Fraudsters are Succeeding Now More Than Ever

We are living in the Scam Age, a time where scams have evolved from crude tactics to sophisticated operations that can dupe even the most skeptical consumers. Fraud is now at epidemic levels, with scammers targeting individuals across all demographics, from young professionals to senior citizens, through various schemes like romance scams, investment scams, and fake job offers. This growing problem is not limited to one region—it has become a global occupation, with organized scam rings operating domestically and internationally.

The Perfect Storm: Why Scams Are So Successful Today

1. Technology Advancement

The rapid advancement of technology has provided scammers with the tools to operate on a much larger scale. Voice over Internet Protocol (VoIP) allows fraudsters to make thousands of calls per day, and data breaches have supplied them with the personal information needed to trick victims. Furthermore, artificial intelligence enables scammers to craft convincing emails, texts, and even mimic voices, making their attacks seem more credible. This technology has significantly reduced the barriers to entry, allowing fraudsters to impersonate trusted institutions and individuals with ease.

2. Increased Digital Reliance

The COVID-19 pandemic pushed more transactions online and left people isolated, making them more vulnerable to scams. Loneliness, stress, and anxiety are significant risk factors for falling victim to fraud, and with many people interacting more online than ever before, scammers can more easily exploit these emotional vulnerabilities. Whether through phishing attacks, fraudulent online ads, or fake investment opportunities, scammers prey on the emotional state of individuals who are already navigating digital spaces more frequently.

3. Globalization of Fraud

Fraud is no longer confined to a few bad actors; it has become an international industry. Organized crime syndicates around the world have recognized the profitability of scamming and have industrialized it. In certain parts of the world, entire scam compounds operate where individuals, sometimes held against their will, are forced to make fraudulent calls or send scam emails. This global network of scammers makes it difficult for any one country or law enforcement agency to combat the problem effectively.

4. Data Breaches Fuel Fraud

Data breaches have become so common that they are almost expected. With every breach, sensitive personal information—Social Security numbers, phone numbers, emails, and addresses—becomes available to cybercriminals. Armed with this data, scammers can impersonate victims in ways that make their fraud attempts highly believable. A simple phone call with the right details can lead to catastrophic financial losses, as scammers easily impersonate banks, government agencies, or even family members.

5. Distrust in Institutions

A major reason scammers are succeeding is the growing distrust in institutions. As people lose faith in the government, media, and financial institutions, they are more susceptible to impostor scams where fraudsters claim to be from these very organizations. The lack of trust in traditional authorities makes it easier for scammers to manipulate individuals into believing false claims, leading them to act against their own best interests.

Fraud as a Lucrative Occupation

For many, fraud has become a full-time occupation. With the rise of online marketplaces on platforms like Telegram, scammers can buy tutorials, scam scripts, and even personal information needed to carry out their schemes. Scamming is no longer limited to low-level criminals; it is now an organized and lucrative industry that attracts both small-time fraudsters and large criminal networks. In some parts of the world, like Southeast Asia, scam networks operate like modern-day mafias, generating billions of dollars annually from their operations.

Fraudsters continue to evolve, adopting new technologies and techniques to stay ahead of law enforcement. AI has become a powerful tool in their arsenal, helping them create more convincing impersonations and avoid detection. As scamming becomes more profitable, the barrier to entry lowers, making it easier for anyone with internet access and malicious intent to become part of this growing criminal industry.

The Path Forward: How eFraud Prevention Can Help

As scams become more sophisticated and pervasive, individuals and institutions need more robust solutions to protect themselves. This is where the eFraud Prevention Platform comes in. Our platform offers a comprehensive approach to fighting fraud, designed to empower both account holders and financial institutions with the tools they need to stay ahead of scammers.

Here’s how the eFraud Prevention Platform can make a difference:

- Fraud Education: We offer fraud prevention tips on every topic, online courses, and interactive quizzes to educate consumers and employees about the latest fraud tactics, helping them stay informed and vigilant.

- Real-time News & Trends: Our platform provides the latest headlines and fraud trends, ensuring that both customers and staff are notified of emerging threats and can take action quickly.

- AI Chatbot Integration: Our 24/7 AI chatbot offers immediate assistance on any fraud-related topic, helping customers resolve concerns and report suspicious activity in real-time.

- Fraud Reporting Tools: With our fraud reporting platform, account holders can easily report suspected scams, ensuring that the bank can respond swiftly and effectively.

- Content Creation: Our platform helps institutions save time by providing pre-written articles, newsletters, and blog content that keep customers informed about fraud prevention.

- Employee Training: We equip bank staff with the knowledge and communication tools necessary to intervene and prevent fraud, both in-person and online.

The eFraud Prevention Platform offers a multi-layered solution that addresses the root causes of fraud—lack of awareness, emotional vulnerability, and technological exploitation. By implementing this platform, banks and credit unions can take a proactive stance in the fight against fraud, protecting their members & customers and reinforcing trust in their services.

Restoring Trust

We are living in the Scam Age, where fraud has become an epidemic that affects millions of people across the globe. Scammers have evolved their tactics, using advanced technology and exploiting emotional vulnerabilities to deceive even the most cautious individuals. As fraud becomes a more organized and global occupation, institutions must take steps to combat it effectively.

The eFraud Prevention Platform is one such solution that offers comprehensive fraud prevention strategies. Together, we can turn the tide on this growing epidemic and restore trust in financial institutions and make a difference in the fight against fraud.