Fraud Awareness Is the New Growth Lever

Fraud is no longer just a defensive concern. For financial institutions willing to rethink their approach, fraud prevention — paired with Account holder-facing awareness — has become a strategic enabler of growth.

From cost center to strategic advantage

For years, fraud programs were designed primarily to stop losses and satisfy risk requirements. Today, that perspective is changing. When fraud risk is managed effectively, institutions can move faster — not slower.

Strong fraud prevention allows organizations to expand into new products, new geographies, and faster payment rails. It enables higher transaction limits for trusted Account holders and supports real-time payments without unacceptable exposure. In many cases, fraud concerns — not technology — are the blocker preventing growth initiatives from launching.

This represents a fundamental shift from fraud as a cost to fraud as a competitive advantage.

Why fraud prevention now differentiates institutions

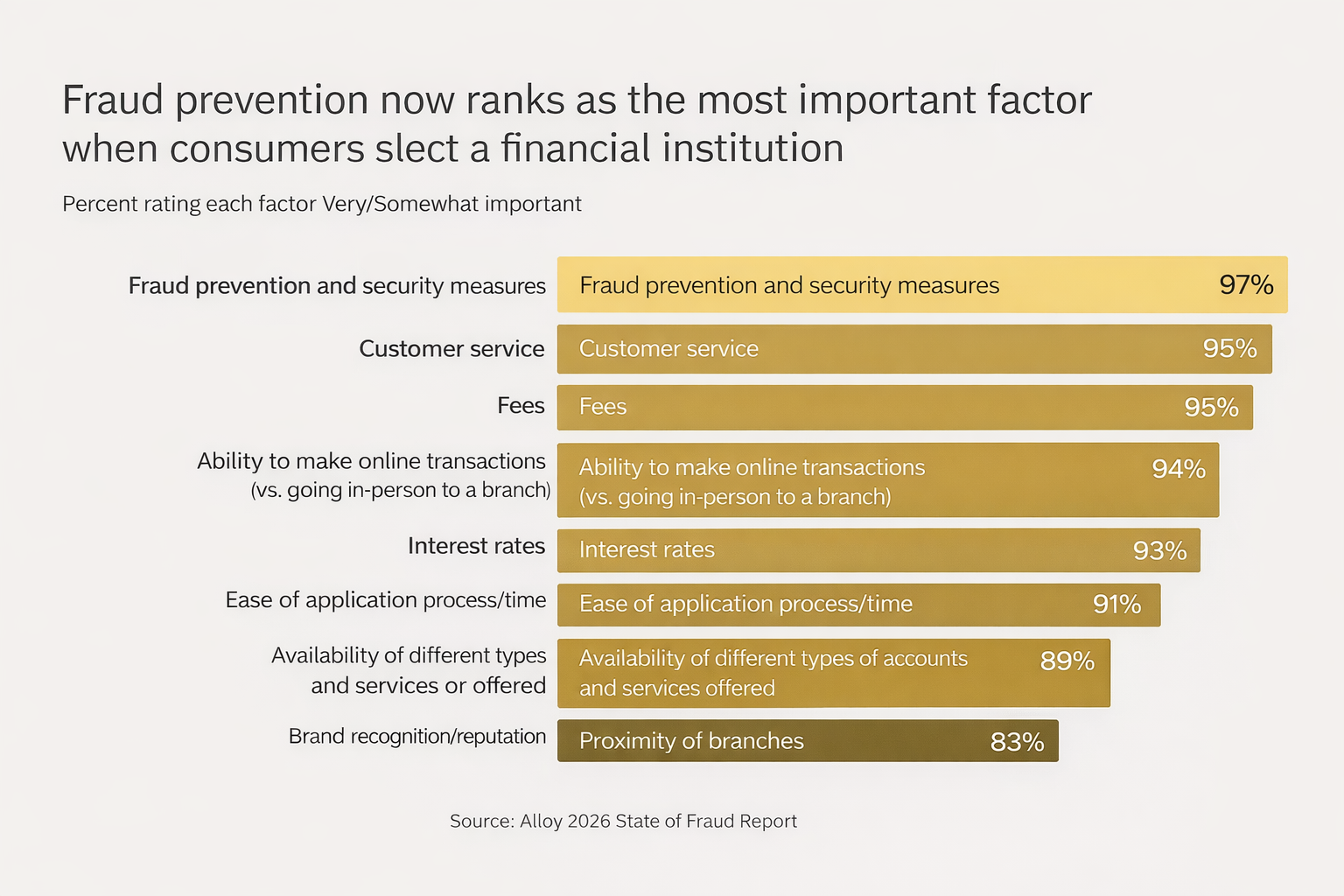

Growth does not occur in a vacuum. It depends on Account holder trust. When consumers evaluate where to bank, fraud prevention and security now rank above traditional factors such as fees, convenience, and branch proximity.

The missing layer: account holder fraud awareness

This shift reframes fraud prevention as a visible signal of institutional competence and care — not merely an internal safeguard. While investments in fraud platforms are critical, outcomes are still shaped by Account holder behavior. Modern scams succeed by exploiting moments of uncertainty — a call, a text, a sense of urgency — when no employee is present.

Why awareness matters

Faster adoption

Account holders who understand fraud risks are more willing to use new digital services and payment capabilities.

Reduced friction

Better awareness lowers false alarms and panic responses that lead institutions to unnecessarily tighten controls.

Stronger loyalty

When Account holders feel protected and informed, trust deepens — and relationships expand.

A new question for financial leaders

The industry has moved beyond crisis management. The question is no longer, “How do we survive fraud?” It is now, “How do we use fraud prevention and awareness to grow?”

Institutions that treat fraud awareness as a core growth capability — not just an internal training exercise — will move faster, build deeper trust, and outperform competitors who continue to view fraud solely as a defensive function.

Fraud prevention stops losses. Fraud awareness unlocks opportunity.