Fraud Awareness Trusted by

Banks & Credit Unions Nationwide

Founded in 2004, eFraud Prevention™ helps financial institutions educate account holders, staff, and communities to prevent scams before money is lost.

Fraud Awareness as a Growth Strategy

What This Is

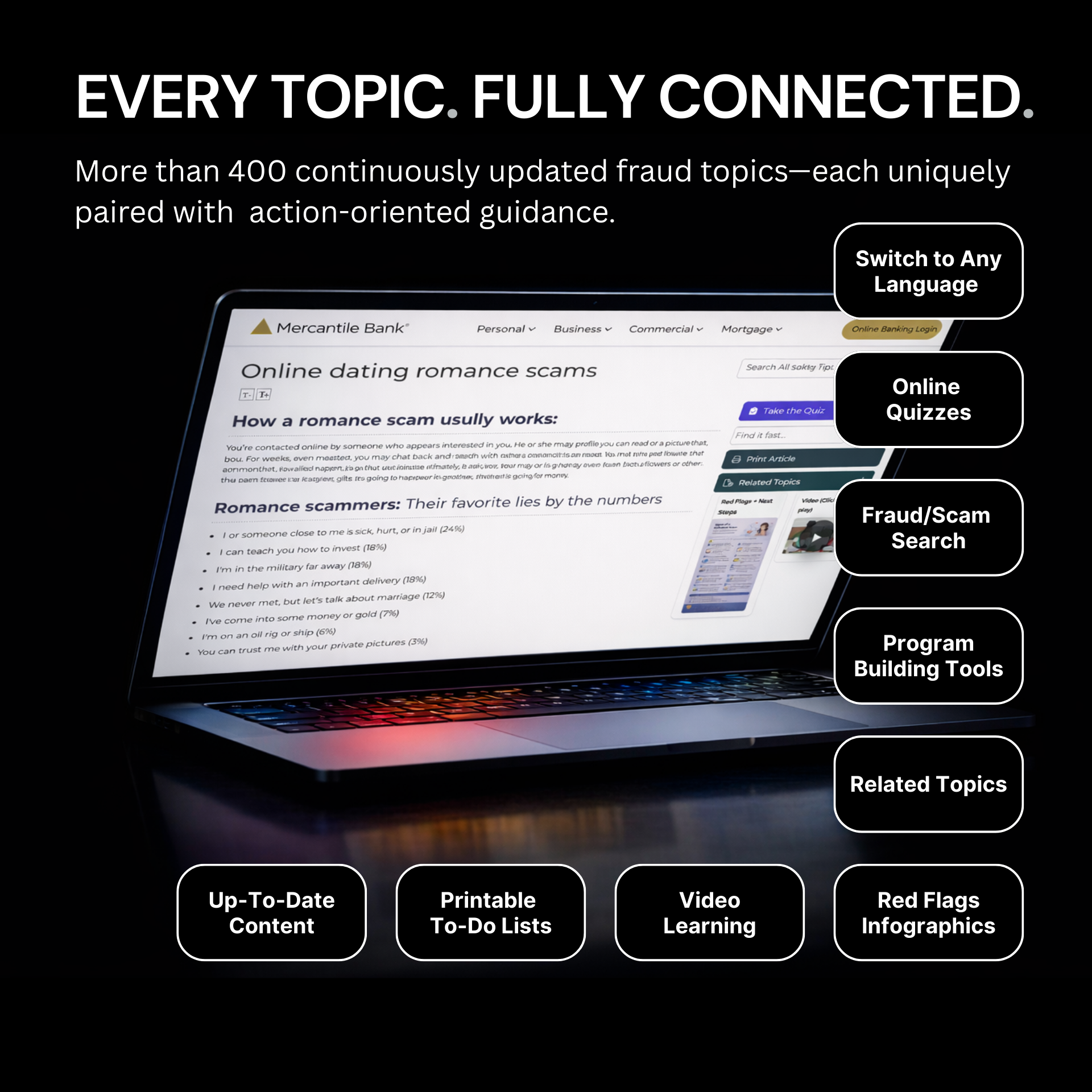

- A fraud awareness and education platform

- Built specifically for banks and credit unions

- Used to educate account holders, staff, and communities

How FI's Use It

- Website fraud education and scam alerts

- Frontline staff and employee awareness training

- Consumer education aligned with regulatory expectations

What We Are Not

- Fraud detection or transaction monitoring software

- Cybersecurity or network protection technology

- A one-time campaign or static content library

What clients say